Investing in real estate has long been a popular way to build wealth and generate passive income. And it’s not hard to see why – real estate offers the potential for high returns, stable appreciation, and a tangible asset that can be leveraged in a variety of ways. But for newcomers, the world of real estate investing can seem daunting and opaque. This article aims to shed light on the different options available to those looking to dive into the world of real estate investment, covering both traditional and modern approaches.

One of the most well-known ways to invest in real estate is through rental properties. This involves purchasing a home, apartment, or commercial space and renting it out to tenants. Being a landlord comes with responsibilities such as maintenance and repairs, but it can also provide a steady stream of income and potential for long-term profits. For those with the time and resources, investing in rental properties can be a rewarding endeavor, offering not only financial gains but also the satisfaction of building a business and providing a service.

Another option for those wanting a more hands-off approach is to invest in Real Estate Investment Trusts (REITs). These are companies that own and operate income-producing real estate, and they offer an easy and diverse way to add real estate to your portfolio. There are many types of REITs, from those focused on residential properties to others specializing in data centers or health care facilities. By investing in REITs, you can gain exposure to the real estate market without the hassle of managing physical properties.

Investing in REITs is much like investing in stocks. You can buy and sell shares on public exchanges, making it a liquid investment. Another benefit is that, by law, REITs must distribute at least 90% of their taxable income to shareholders as dividends. This makes them an attractive income-generating investment, particularly for retirees. Of course, as with any stock investment, there are risks, and the value of your REIT shares can fluctuate with the market.

For those wanting a more direct but still relatively hands-off approach, investing in rental properties through a property management company is an option. This involves purchasing a property and then hiring a company to handle the day-to-day management, including finding and screening tenants, collecting rent, and coordinating maintenance and repairs. While this method does require a more substantial upfront investment, it can be a good option for those with the means, offering the potential for steady income and long-term capital appreciation.

Crowdfunding platforms have opened up a new avenue for real estate investing, allowing multiple investors to pool their money together to fund a project. This model has several benefits, including lower financial barriers to entry and a more diverse portfolio of projects to choose from. Typically, these platforms allow investors to browse a range of potential investment properties, review the details and projected returns, and then invest as little as $1000. The platform then handles the rest, including the legal and financial aspects, providing regular updates to investors, and distributing returns.

Investing in real estate through a Limited Partnership (LP) or Limited Liability Company (LLC) structure is also an option worth considering. This approach offers liability protection and potential tax benefits. By setting up an LLC or LP, you create a separate legal entity that owns and operates the investment property, shielding your personal assets from potential liabilities. This structure also provides flexibility in management and ownership distribution and can offer tax advantages, including pass-through taxation, where income is taxed only at the owner level, not the business level.

Another strategy to consider is investing in real estate through a self-directed IRA (Individual Retirement Account). This approach allows you to use pre-tax dollars to invest in a variety of assets, including real estate, offering potential tax benefits. With a self-directed IRA, you have control over the investment choices, and any income or gains generated by the real estate investments grow tax-deferred or even tax-free if you have a Roth IRA. It’s important to note, however, that there are rules and restrictions, such as not being able to use the property for personal benefit until you retire, and certain transaction types, like investing in a property you already own, are prohibited.

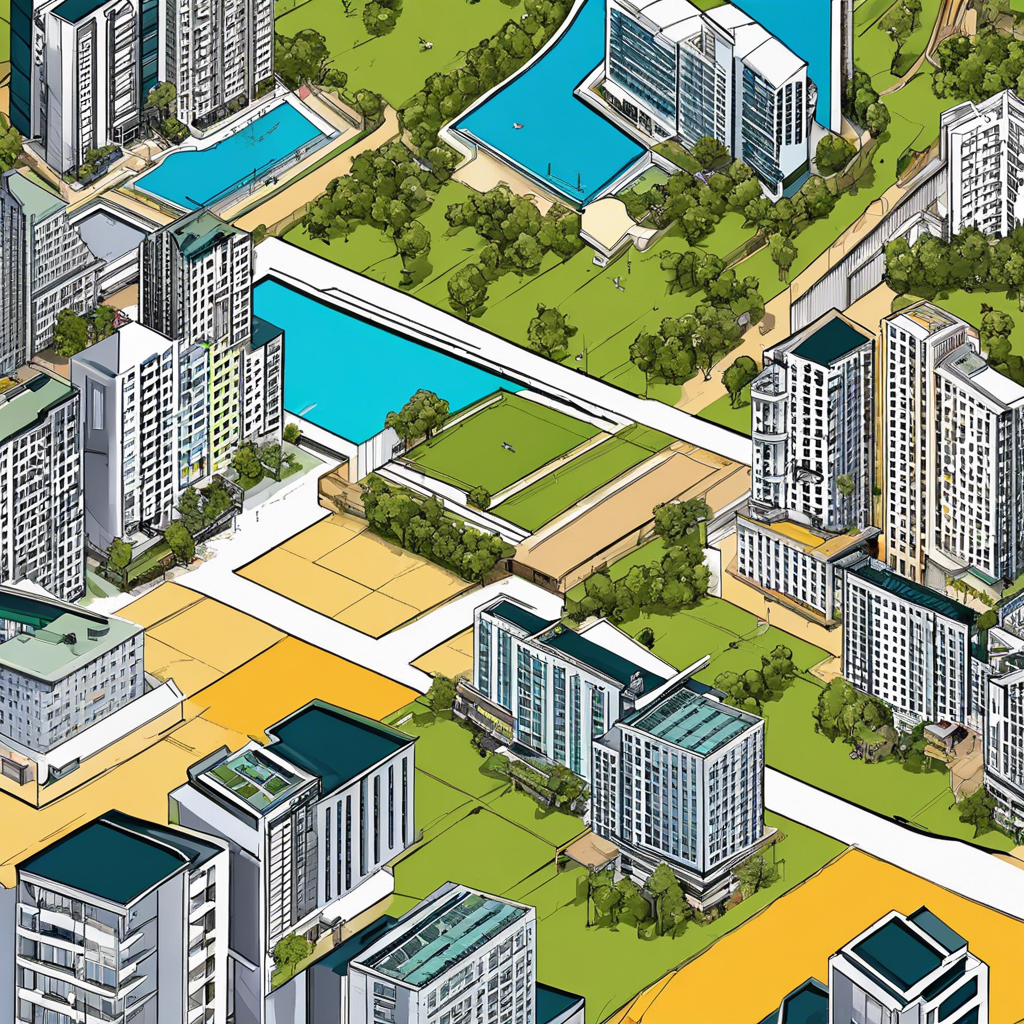

Finally, for those with an interest in real estate development, there is the option to invest directly in projects. This could involve purchasing land and developing it yourself or partnering with a developer to fund a project in exchange for a share of the profits. This approach can be risky, as development projects can be complex and subject to many variables, but it can also be rewarding, offering the potential for significant financial returns and the satisfaction of seeing a project through from start to finish.

In conclusion, there are numerous ways to invest in real estate, each with its own unique benefits and considerations. Whether you’re interested in a hands-on or hands-off approach, there are options available to help you build wealth and generate income through this valuable asset class. Remember to do your research, understand the risks and potential rewards, and consider seeking professional advice before diving into any investment opportunity. Happy investing!